Supportive Government Policies

Government policies in Canada are increasingly supportive of the small cell-networks market, facilitating the deployment of advanced telecommunications infrastructure. Initiatives aimed at enhancing digital connectivity, particularly in underserved regions, are encouraging investments in small cell technology. The Canadian government has allocated approximately $1 billion to improve broadband access across the country, which includes funding for small cell deployments. This financial backing is likely to stimulate growth within the small cell-networks market, as it enables operators to expand their networks and enhance service delivery. Furthermore, streamlined regulatory processes for small cell installations are expected to reduce barriers, making it easier for companies to implement these solutions.

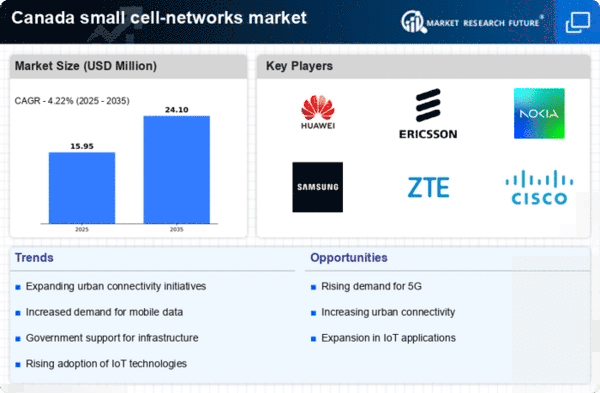

Increased Mobile Data Consumption

The small cell-networks market in Canada is significantly influenced by the increased consumption of mobile data. With the rise of streaming services, social media, and mobile applications, data usage has skyrocketed. Statistics show that mobile data traffic in Canada is anticipated to grow by 50% annually, placing immense pressure on existing network infrastructures. Small cell networks offer a solution by providing localized coverage and offloading traffic from macro networks. This trend indicates a strong potential for growth within the small cell-networks market, as telecommunications providers seek to enhance capacity and ensure quality service for their customers.

Growing Demand for Enhanced Connectivity

The small cell-networks market in Canada is experiencing a surge in demand for enhanced connectivity solutions. As urban areas become increasingly populated, the need for reliable and high-speed internet access intensifies. This demand is driven by the proliferation of smart devices and the Internet of Things (IoT), which require robust network infrastructure. According to recent data, urban centers in Canada are projected to see a 30% increase in data traffic by 2026, necessitating the deployment of small cell networks to alleviate congestion in existing macro networks. The small cell-networks market is thus positioned to benefit from this growing demand, as service providers seek to improve user experience and meet the expectations of consumers for seamless connectivity.

Rising Adoption of Smart City Initiatives

The small cell-networks market is being propelled by the rising adoption of smart city initiatives across Canada. Municipalities are increasingly investing in technology that enhances urban living, including smart lighting, traffic management, and public safety systems. These initiatives often rely on robust wireless infrastructure, which small cell networks can provide. As cities aim to improve efficiency and sustainability, the integration of small cell technology becomes essential. Reports indicate that Canadian cities are expected to invest over $2 billion in smart city projects by 2027, creating a substantial opportunity for the small cell-networks market to expand its footprint and support these transformative urban developments.

Technological Advancements in Network Solutions

Technological advancements are playing a crucial role in shaping the small cell-networks market in Canada. Innovations in network solutions, such as the development of advanced antennas and software-defined networking, are enhancing the efficiency and performance of small cell deployments. These advancements enable operators to optimize their networks, reduce operational costs, and improve service quality. As technology continues to evolve, the small cell-networks market is likely to see increased investment in research and development, fostering a competitive landscape. The integration of artificial intelligence and machine learning into network management systems may further streamline operations and enhance user experiences, positioning the industry for sustained growth.